Are you ready for tax time? With the deadline for tax submissions fast approaching, it’s time to get organized. Whether you’re a small business owner, a rideshare partner, a full-time or part-time employee, a contractor, or even a stay-at-home parent—your professional status doesn’t matter. One thing is for sure: you need a clear view of your expenses from the past 12 months.

Why is it important to analyze your expenses? Tax season is the perfect opportunity to categorize your spending in a way that makes sense. From essential household costs to tax-deductible purchases and charitable donations, understanding where your money went can help you save time, reduce stress, and potentially increase your tax refunds.

But let’s face it—manually sifting through bank statements or navigating expensive tools on the market can be overwhelming. That’s where Remote Buddy comes in.

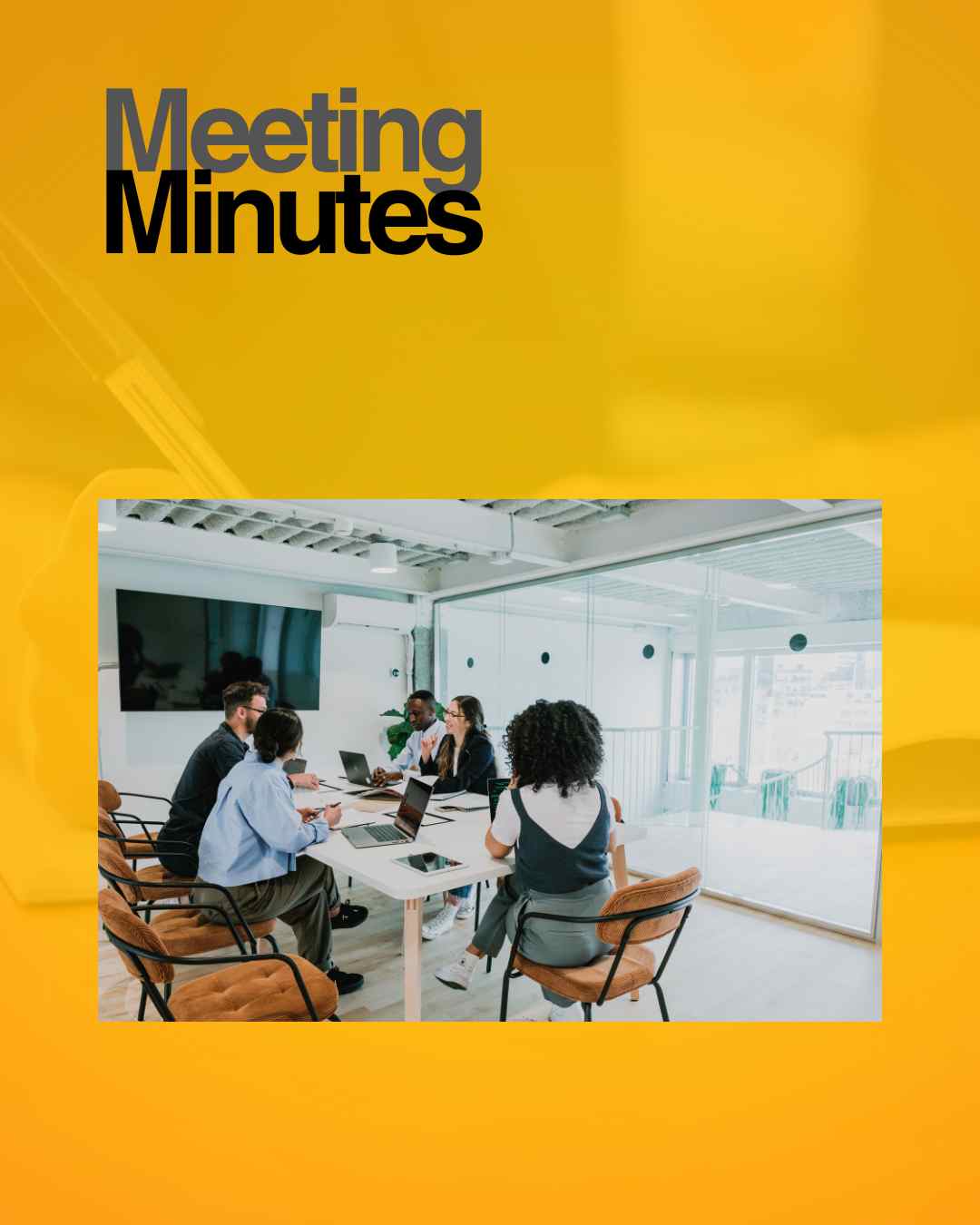

Here’s how we make it easy for you:

- Comprehensive Analysis: Simply provide us with your bank statements for the last financial year (July 1 to June 30).

- Accurate Categorization: We’ll input everything into a detailed Excel sheet, categorizing every expense in the most efficient and meaningful way.

- Cost-Effective Solutions: Forget expensive software—our tailored service is budget-friendly and effective.

With Remote Buddy, you’ll be able to clearly see how much you’ve spent on food, household needs, and other expenses, while identifying tax-deductible items and donations. It’s the simplest, most hassle-free way to prepare for tax season.

Your role? Just three simple steps:

- Reach out to us for a quick chat about your needs and get a customized quote.

- Send us your bank statements.

- Review the organized and categorized results we provide.

It’s really that easy. Let us handle the heavy lifting while you focus on your day-to-day responsibilities.

Let’s Get Started Why stress over spreadsheets when Remote Buddy can take care of it for you? Contact us today to start your free trial, and see for yourself how we can simplify your tax preparation process!